If you have any questions please contact Amanda Vert at (810) 762-0523 or accounts.payable@mcc.edu.

If you need an enclosure/attachment to go with a payment, there are two options:

Certain transactions do not require purchase orders or receiving/acceptance and are best accomplished with a Direct Voucher Payment (DVP) requisition. Supporting documentation is sent to Mott Accounts Payable after requisition is fully approved.

DVP transactions are:

The college uses the fixed asset module in Datatel to track inventory. If a DVP is used instead of a PO, the inventory tracking and recording process is compromised. For proper internal controls, and inventory tracking, (as well as many other reasons) tangible items require a PO.

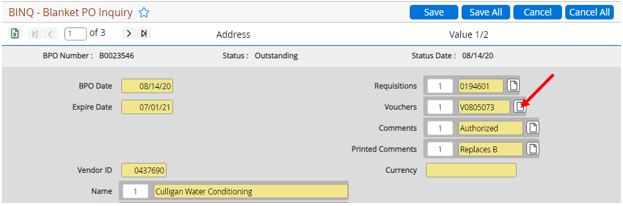

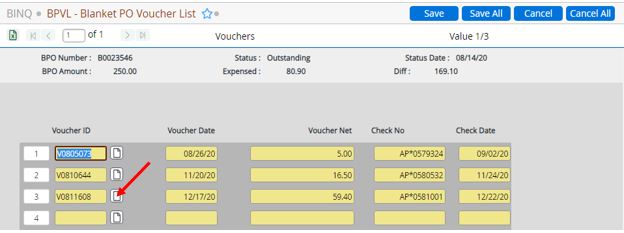

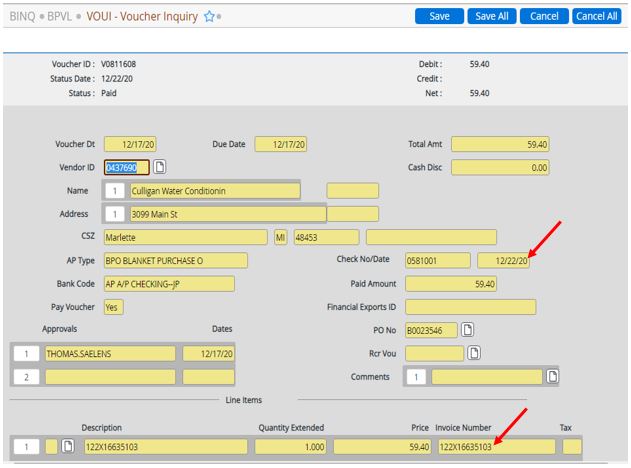

Blanket Purchase Order (BPO) is a contract between the college and a vendor. It is generally used for repetitious payments for contractual services such as payment for leased equipment or room renovations.

Purchase Order (PO) is an offer by the college to contract with a vendor for the delivery of supplies or the performance of a service for an agreed upon price under specified terms and conditions. Any good or service that is quantifiable in number and description should be ordered using a purchase order.

If you have questions on requisitions for purchase orders or blanket purchase orders, please contact the purchasing department.

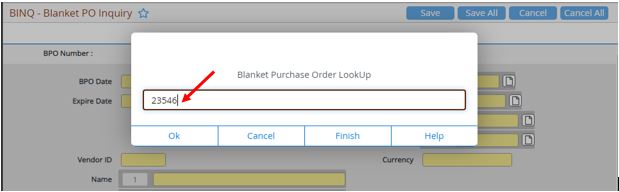

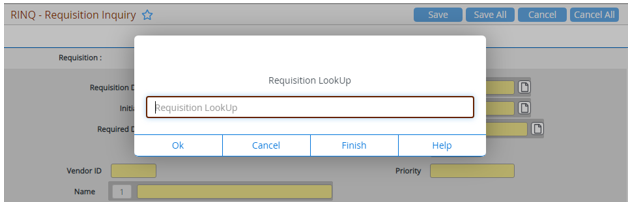

The PO # and voucher # can be found in RINQ. Initiators should check the status of requisitions frequently.

Always ensure the documentation contains a service/event date†.

To designate a payment as prepaid, enter/select “PD “in the “Terms” field on the requisition in Datatel.

After the items/services arrive/are completed, notify Mott Receiving to have the status changed to "Accepted." Submit a copy of the vendor's receipt or invoice marked paid/zero balance to Mott Accounts Payable to clear the prepayment. Ensure you write “Clear Prepay PO _____” on the receipt. (You can look up the PO# using RINQ.)

Prepaids are encumbered against the cost center's budget when the requisition is entered. Proper accounting controls are maintained by tracking outstanding advances in a prepaid expense account. This is monitored by the accounting office. When the prepaid is cleared, the encumbrance is relieved, the advance account is cleared, and actual expenditures are posted to the cost center.

† Proper accounting standards are followed which state we must charge items to the proper fiscal year. For items that cross fiscal years, we are especially careful to charge the expense in the fiscal year in which the goods and/or services are received.

The Internal Revenue Service 2025 standard mileage rate is $.70